Our clothers dryer crapped out last week, and the washer’s not doing so well either. Repairs expensive, time to replace them both. Home Depot offering a honkin’ pile of rebates, and has the unit Consumer Reports likes. Once there, learned that if we open a Home Depot credit card, we could get an additional 10% off. No penalties, what’s not to like?

Read recently that financial institutions cannot legally require you to provide a social security number, so decided to see what would happen if I entered all zeroes in that field. The application was spit back in seconds. Explained my position to the employee, who rang up credit central at HD. The guy I talked to wasted no time in invoking … wait for it … The Patriot Act in defense of the requirement. He didn’t have specifics, but claimed that the act required them to store this information, and that a separate taxpayer ID would not suffice.

I was incredulous. Either Home Depot is hiding behind the war on terror for capitalistic reasons, or the Patriotic Act is more frightening than I thought. I suspected the latter, but realized I wasn’t going to get anywhere in this round, so, with a four-year-old growing quickly impatient, forked over my SS# and took the discount. Tonight did a bit of research and found this at askquestions.org:

If you’d just like to open a bank account or engage in another banking transaction, can a bank force you to provide your social security number? How about fingerprinting you? Are either of these strictly required by law? Not exactly – although if you do not wish to provide your social security number you will have to obtain an alternate taxpayer identification number.

So if their reading of the act is correct, Home Depot was not within their rights to require this information. A little late now, but am curious just how hard a person would have to fight to get Home Depot credit approval without a valid social.

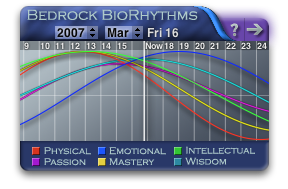

Lately feeling like I’d reached an all-time low – exhausted, sick, stressed, imbalanced, under-excercised, just out of sorts in every way. Then it hit me – my biorhythms must be off! Haven’t seen one of those machines around for years, but knew there had to be a software version out there somewhere. Struck gold with the

Lately feeling like I’d reached an all-time low – exhausted, sick, stressed, imbalanced, under-excercised, just out of sorts in every way. Then it hit me – my biorhythms must be off! Haven’t seen one of those machines around for years, but knew there had to be a software version out there somewhere. Struck gold with the